Investigating EU subsidies

Estimating the effectiveness of EU subsidies given to small and medium-sized firms

Around 2017, while working at the National Bank of Hungary, we obtained access to a database containing information about all EU subsidies distributed under a couple of subsidy schemes (so-called operational programs) in the 2007–2015 period. Together with data on Hungarian firms’ financial reports, and data about their bank loans, it allowed us to examine the efficacy and effectiveness of EU subsidies from various angles.

It led to a multi-year research projects, and resulted in the publication of a number of resesearch papers, internal policy reports, and newspaper articles. The original team consisted of Ádám Banai, Péter Lang, Gábor Nagy and me from the National Bank of Hungary, and we were later joined by Eszter Balogh and Álmos Telegdy from the bank, and Goel Tirupam and Előd Takáts from the BIS. A spin-off of the research project is still ongoing, conducted by some of the aforementioned people.

In a nutshell, the main outcomes of the research were the following:

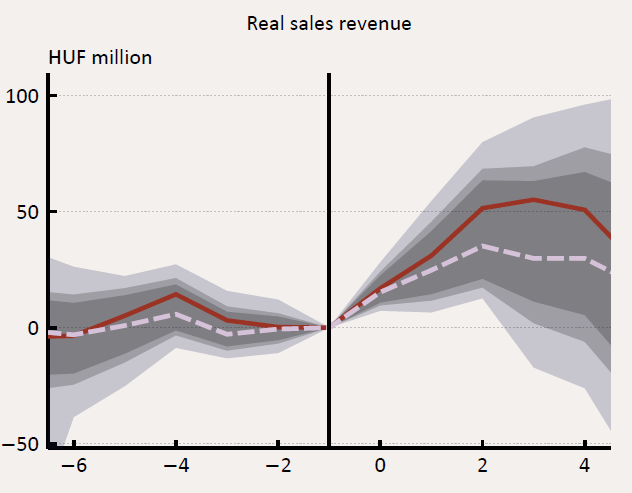

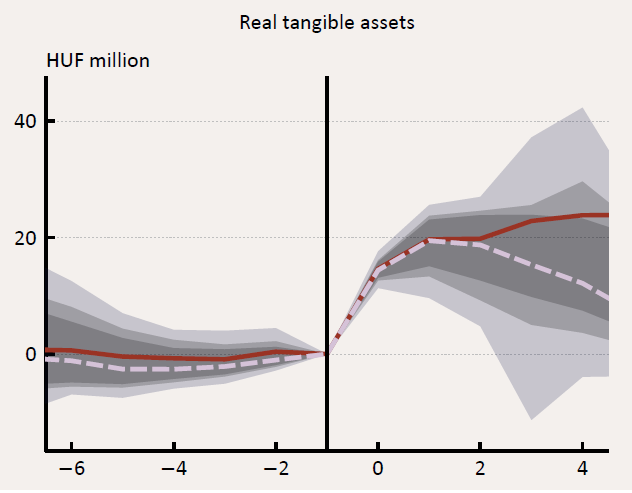

- EU funds had a significant positive effect on the number of employees, sales revenue, gross value added and, in some cases, operating profit. That is, they helped firms firms grow.

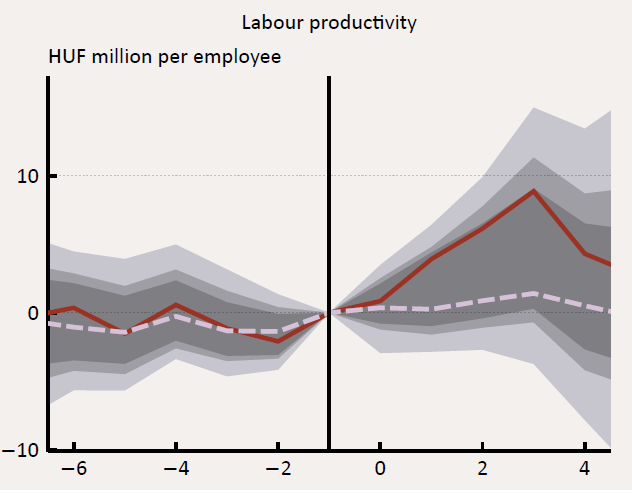

- On the other hand, we have found no significant increase in productivity or ROA.

- Furthermore, refundable subsidies seem to be just as effective as non-refundable ones.

- The positive impact seems to be larger for credit constrained firms, but this difference is transitory.

For more details, check out some of the research papers associated with the project:

- Impact evaluation of EU subsidies for economic development on the Hungarian SME sector

Ádám Banai, Peter Lang, Gabor Nagy, and Martin Stancsics

MNB Working Papers, 2017/8 - A gazdaságfejlesztési célú EU-támogatások hatásvizsgálata a magyar kkv-szektorra (Hungarian)

Ádám Banai, Peter Lang, Gabor Nagy, and Martin Stancsics

Közgazdasági szemle 64.10 (2017) - Waste of money or growth opportunity: The causal effect of EU subsidies on Hungarian SMEs

Ádám Banai, Peter Lang, Gabor Nagy, and Martin Stancsics

Economic Systems 44.1 (2020) - Credit constrained firms and government subsidies: evidence from a European Union program

Eszter Balogh, Adám Banai, Tirupam Goel, and Péter Lang, Martin Stancsics, Előd Takáts and Álmos Telegdy

BIS Working Papers No 984 / MNB Working Papers, 2021/5

Alternatively, for a less technical write up, read our article on portfolio.hu (Hungarian only).